National Multifamily Report – April 2024

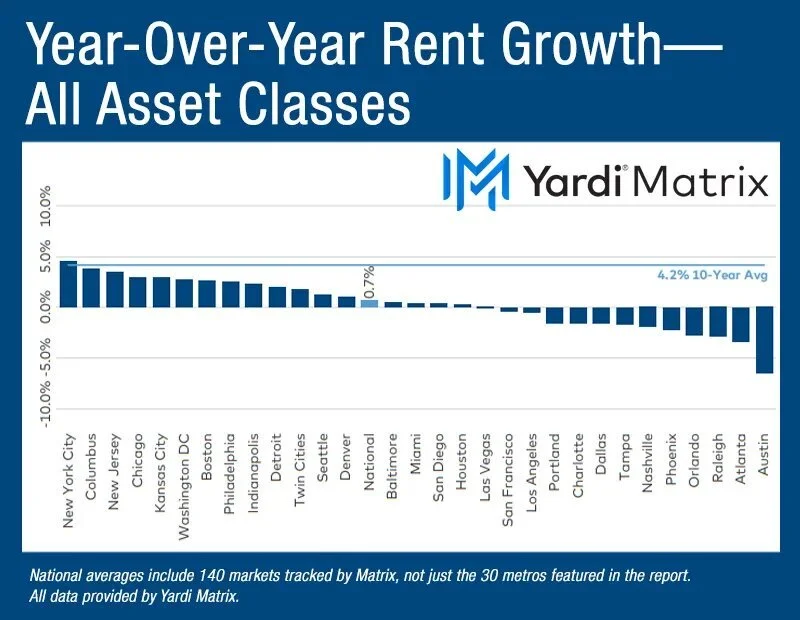

Year-over-year multifamily rent growth, all asset classes. Chart courtesy of Yardi Matrix

The average multifamily rent rose 0.7 percent year-over-year through April, or $6 to $1,725, just $2 short of the all-time high set last summer.

At the start of the second quarter, the U.S. multifamily market showed good progress, with the average asking rent trending up for the second consecutive month, according to the latest Yardi Matrix survey of 140 markets. The rate rose 0.7 percent year-over-year in April, a $6 gain to $1,725, up $12 year-to-date and just $2 off the all-time high set last summer. National occupancy remained at 94.5 percent in March, a rate held since the beginning of the year. Meanwhile, the single-family rental segment also posted its second consecutive strong month this year, with rents up 1.3 percent year-over-year, or $9 to $2,154 in April.

Markets in the Northeast and Midwest continued to post the highest rent increases, led by New York City (4.6 percent year-over-year), Columbus (3.8 percent), New Jersey (3.5 percent), and Chicago and Kansas City (both 2.9 percent). Rent contractions of 3.0 percent or more year-over-year were registered only in Austin (-6.5 percent) and Atlanta (-3.4 percent) among Matrix’s top 30 markets. By asset class, Lifestyle rent was negative (-0.6 percent) and RBN positive (1.9 percent). Occupancy dropped in 28 of the top 30 markets and slipped below 93 percent in four markets: Atlanta (92.4 percent), Houston (92.6 percent), Las Vegas (92.7 percent) and Austin (92.8 percent).

On a monthly basis, rents rose 0.3 percent across asset classes. Boston (1.1 percent), Detroit (0.9 percent) and Philadelphia (0.8 percent) led in monthly rent gains. The largest declines were recorded in Austin, Tampa and Raleigh (each down 0.3 percent). New Jersey led in Lifestyle rent growth and Nashville in RBN, each up 1.2 percent. Austin still struggled (-0.2 percent in Lifestyle and -0.4 percent in RBN), as well as Raleigh (-0.1 percent in Lifestyle and -0.8 percent in RBN).

Markets with tepid rent growth post high absorption

Demand for apartments is sustained by high levels of household formation, which is aided by strong job market, immigration and ongoing migration to the South and West. Absorption is below 2021’s peak level (620,000 units), but the 72,800 units absorbed in the first quarter set the stage for a solid year that might surpass 2022 and 2023. Q1 demand was highest in the Southwest (18,000 units) and secondary metros (47,100 units).

Renewal rent growth rose 4.4 in March, up 80 basis points from February. The rate remained below 5.0 percent since October and was 660 basis points lower than the peak in August 2022. The highest renewal rent growth rates were in Columbus (10.0 percent), Kansas City (9.4 percent) and Miami (7.7 percent). Three metros posted negative renewal rent growth—San Francisco (-0.6 percent), Austin (-1.4 percent) and Los Angeles (-15.4 percent). Meanwhile, the national lease renewal rate averaged 65.8 percent in March. The highest rate was in New Jersey (83.8 percent) and the lowest in Los Angeles (56.1 percent).

The average rent in the single-family build-to-rent segment rose 1.3 percent year-over-year through April, or $9 to $2,154, 10 basis points above the previous month. National SFR occupancy stood at 95.4 percent in March, higher in RBN (96.6 percent) than in Lifestyle (95.0 percent).