Real Estate Market Trends, Industry Analysis and Investment Opportunities to 2030, Featuring Profiles of 409 Key Players

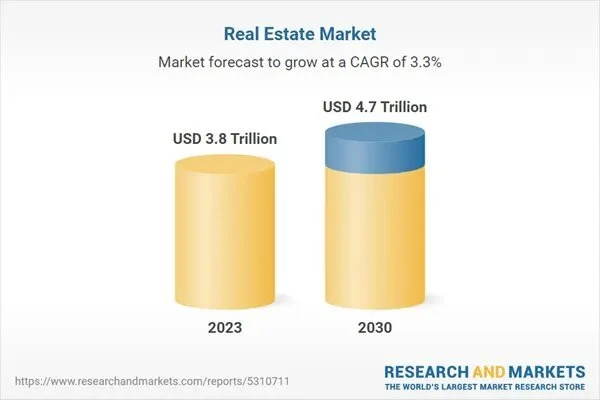

The global market for Real Estate was estimated at US$3.8 Trillion in 2023 and is projected to reach US$4.7 Trillion by 2030, growing at a CAGR of 3.3% from 2023 to 2030. This comprehensive report provides an in-depth analysis of market trends, drivers, and forecasts, helping you make informed business decisions.

Gain insights into the U.S. market, which was valued at $1.1 Trillion in 2023, and China, forecasted to grow at an impressive 5.1% CAGR to reach $817.7 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Technological Innovations Transforming the Real Estate Industry

Technological innovations are dramatically reshaping the real estate industry, enhancing everything from property management to buying and selling processes. The rise of PropTech (property technology) is enabling real estate professionals to use data analytics, virtual tours, and AI-driven platforms to offer more personalized and efficient services. Virtual reality (VR) and augmented reality (AR) technologies are revolutionizing property viewing, allowing potential buyers and renters to explore properties remotely.

Additionally, smart building technologies are improving energy efficiency and security in both commercial and residential properties, aligning with the growing demand for sustainable real estate solutions. These technological advancements are making the real estate industry more accessible and efficient.

Market Trends Influencing the Real Estate Sector

Several key trends are shaping the real estate sector, particularly the shift toward urbanization and the growing demand for sustainable and energy-efficient properties. In many parts of the world, the demand for affordable housing is increasing as populations move to urban centers in search of economic opportunities. This is driving both government initiatives and private sector investments in large-scale residential projects.

Additionally, the rise of remote work and flexible office arrangements is transforming the commercial real estate market, with demand for co-working spaces and smart office solutions on the rise. The push for sustainability in construction and property management is also driving innovations in green building practices and energy-efficient designs.

Growth in the Real Estate Market

The growth in the real estate market is driven by several factors, including rising urbanization and population growth, which are fueling demand for residential and commercial properties. Technological advancements in PropTech, including data analytics, virtual reality, and smart building solutions, are enhancing property management and sales processes, making real estate transactions more efficient and transparent. The increasing focus on sustainability and energy efficiency is driving demand for green buildings and eco-friendly developments.

Additionally, the rise of remote work is reshaping the commercial real estate landscape, with growing interest in flexible office spaces and smart building solutions. These factors, combined with real estate's role as a key investment asset, are contributing to the sector's continued expansion.

Report Features:

Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2023 to 2030.

In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

Company Profiles: Coverage of major players such as American Tower, Aston Pearl Real Estate, AvalonBay Communities, and more.

Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Select Competitors (Total 409 Featured):

American Tower

Aston Pearl Real Estate

AvalonBay Communities

Ayala Land Inc.

CBRE Group, Inc.

Central General Development Co. Ltd.

Dalian Wanda Group

Equity Residential

Gecina

Grainger PLC

LeadingRE

Link REIT

Prologis

Segro

Simon Property Group

Sinar Mas Land

Welltower

MARKET OVERVIEW

Influencer Market Insights

World Market Trajectories

Impact of COVID-19 and a Looming Global Recession

Real Estate - Global Key Competitors Percentage Market Share in 2024 (E)

Competitive Market Presence - Strong/Active/Niche/Trivial for Players Worldwide in 2024 (E)

MARKET TRENDS & DRIVERS

Rising Demand for Affordable Housing Due to Urbanization and Population Growth

Increasing Focus on Sustainability and Green Building Practices

Technological Advancements in Real Estate Platforms and Property Management Solutions

Growing Use of Big Data and AI for Real Estate Market Analysis and Pricing

Expansion of Real Estate Investment Trusts (REITs) in Emerging Markets

Impact of Remote Work on Commercial Real Estate and Office Space Demand

Growing Popularity of Smart Homes and Connected Building Technologies

Increasing Demand for Mixed-Use Developments in Urban Centers

Government Policies and Incentives Supporting First-Time Homebuyers

Opportunities in Real Estate Markets in Developing Economies

Rising Interest in Sustainable, Energy-Efficient Residential and Commercial Buildings

Surge in Green Building Practices and Sustainable Construction

Adoption of PropTech for Smart Building and Facility Management

Growing Demand for Mixed-Use Developments in Urban Areas

Expansion of Affordable Housing Projects Driven by Government Policies

Shift in Consumer Preference Toward Co-Living and Co-Working Spaces

Increased Investment in Real Estate by Institutional Investors

Rising Demand for Residential Properties in Suburban Areas

Advances in 3D Printing and Prefabrication Techniques in Construction

Integration of AI and Big Data for Property Valuation and Market Analytics

For more information about this report visit here